Join The Turlington-Rix Scholarship Fund

With a few of the greatest develops in the houses adore within the more than a decade for the Ontario combined with number-cracking sales numbers during 2020 and you can through the basic quarter off 2021, the need for financial investment is increasing. Individuals seeking snap right up belongings in addition to existing property owners who wish to tap into particular considerable expands home based security are exploring financial loans.

Should your borrowing was exemplary and your money is simple so you're able to assess of the a mortgage lender then the financial institutions would be giving certain really competitive borrowing costs right now. For those which have adequate borrowing, credit unions and you will faith organizations deliver financial selection. What if a debtor has less than perfect credit? Exactly what lending options will still be open to those that can't demonstrate creditworthiness? Personal loan providers are very well established in it State who will be in a position to promote secured private financial money whenever credit is actually good obstacle in order to home loan financial support.

You age matter because the most other words you have got most likely read. Have you ever read the term difficult lenders otherwise tough lending. That it name is employed appear to into the Western instructions geared towards individual credit and other platforms such as American monetary stuff.

The definition of hard money financing in america is basically an identical procedure as personal lending. When you look at the Canada, however, there are Provincial rules positioned regarding the section of individual financing. All of our regulations will vary into the Canada. The specific definition of difficult currency credit is simply a primary-identity planned real estate loan that's protected up against the family. Our home can be used as equity, to phrase it differently, to help you leverage the borrowed funds.

Therefore independently credit (tough currency lending) private loan providers need to assess carefully the new appraised newest value of the brand new possessions that they can feel securing financial loans against. Tough currency lending lies in determining risk. To mitigate chance, lenders will ensure while the ideal they're able to your money commonly be there to settle the mortgage.

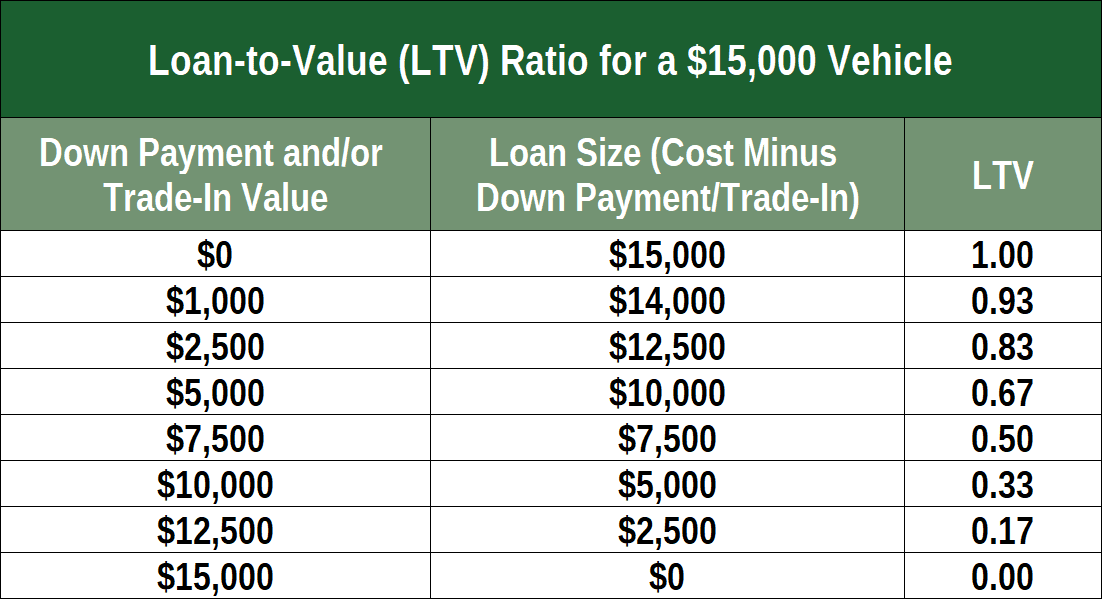

On home loan industry, the fresh new proportion of your own worth of the house as compared to loan amount demand is referred to as Financing-To-Really worth (LTV). Throughout the field of tough lending, the loan amount that's signed commonly seldom meet or exceed 75% LTV.

The fresh new picture one private loan providers and you can lenders throughout credit kinds fool around with when calculating mortgage quantity and you may interest levels appear to be this: Equation: Loan/Value= LTV. The fresh new picture breaks down because the actually loan worthy of (requested home loan amount) split from the appraised well worth (the value of the home in question.)

Eg, if property deserves 800,000 when it comes to their most recent appraised worth then a fair loan amount might possibly be 600,000 and therefore stands for 75% of one's appraised property value the house or property otherwise 75% LTV.

Whenever structuring a difficult currency mortgage, lenders and additionally banks, credit unions plus private lenders constantly paid down significant attention to the amount the newest homeowner are asking in order to obtain. The borrowed funds number are contingent about precisely how much could be used down since the a downpayment ( if this is a principle loan) and/or present collateral in the home for other covered financial choice eg 2nd mortgage loans, Household Security Credit lines (HELOC), Family Guarantee funds, or discussing terminology to have yet another idea financial towards the a preexisting assets.

To possess Ontario individuals seeking to safe mortgage financial support having a primary financing for the certain assets, new deposit has been essential whenever credit using an exclusive lender. The simple truth is you to definitely long lasting category of bank a debtor was handling, age-dated home loan principle can be applied the greater amount of you could establish the better the general terms off a mortgage.

When the a current homeowner is looking for a difficult currency loan in the the type of an extra home loan to their property, next a deposit is an issue. In this situation, the loan financing depends towards the both the LTV, brand new appraised worth of the property, in addition to standard of equity you to definitely exists home one to the borrowed funds is leveraged against.

Generally, difficult currency loan providers is charging significantly more than simply the financial equivalents. It relates straight to the elevated exposure you to definitely private lenders deal with whenever lending to help you borrowers that have bad credit otherwise hard to determine income. Tough money lenders will also lend to help you homeowners that dropped towards default with regards to mortgage repayments.

Because of the financing aside difficult currency finance using current equity, such money can help bring home owners away from financial arrears when you find yourself providing the chance to enhance their creditworthiness if costs was consistently made in full and on-time monthly.

Interest levels from the tough currency money always slip anywhere between eight% to a dozen% with respect to the book monetary image of new borrower/citizen. Fees with the tough currency money have a tendency to fall ranging from step three% in order to 6% of the total cost of financing.

On Mortgage broker Store our americash loans Santa Margarita company is really proficient in every type from financial lending options provided with specialized degree with regards to to personal home loan lending. With entry to an over-all system out of regional private lenders within the your area, we have been more happy to address any concerns it's also possible to has actually which help you achieve your home loan wants because of the leading your off to the right home loan company to negotiate the best terms so you can suit your novel monetary situations.